The best bookkeeping payroll tax services for small businesses

Bookkeeping Services

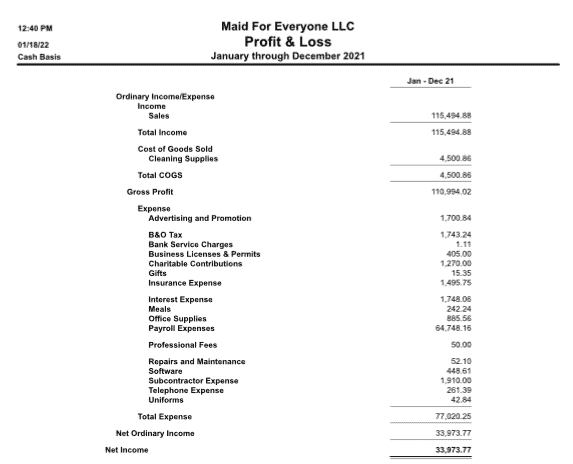

Whether you’re using Quickbooks Desktop, Quickbooks Online, Wave, or Xero – we work the tools you already have to reconcile your bank accounts and produce tax-ready financial to file your tax return at the end of the year.

Since we take care of your bookkeeping, we have the unique opportunity to analyze every transaction and ensure you receive every deduction possible.

You will be assigned an accountant that you can chat with via instant message and email. It’s the same person, every time.

We Work With the Tools You Use

Whether you use Quickbooks Desktop, Quickbooks Online, Wave, or Xero, we complete your financial statements ready for your tax filings.

We Analyze Every Transaction

Since we take care of your bookkeeping, we have the unique opportunity to analyze every transaction and ensure you receive every deduction possible.

We Fix Every Issue as Standard

We go back through your transactions to ensure there are no mistakes in the filing periods we handle for you at no extra charge. A full review is standard.

Join the hundreds of small businesses that rely on MassTax to handle their bookkeeping

Our bookkeeping packages are designed to relieve the stress of having accurate and tax-ready financial statements to file your taxes at the end of the year. We’ll get everything reconciled, and ready, to file your business taxes stress-free with ease.

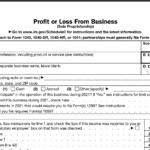

Business Tax Preparation

Whether you’re a Sole Proprietor filing a Schedule C, a Partnership filing a form 1065, or an LLC or S-Corporation filing an 1120s, we handle it all for you.

When you subscribe to our bookkeeping and tax preparation package, your business tax return preparation is included in your monthly fee.

Your monthly fee covers your bookkeeping, business tax return, and individual tax return for one business and one partner.

No subscription? No problem! Check out our Corporate Tax Return Pricing.

Business Tax Preparation

We take care of your business tax preparation start to finish, giving you peace of mind that your return is filed on time and accurately. We’ll review your bookkeeping prior to filing your return to ensure ultimate accuracy.

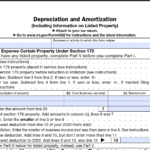

Fixed Asset Management

We’ll create and manage any depreciation and amoritzation schedules necessary to file your returns, and update your financial statements to reflect current depreciation and amortization expenses.

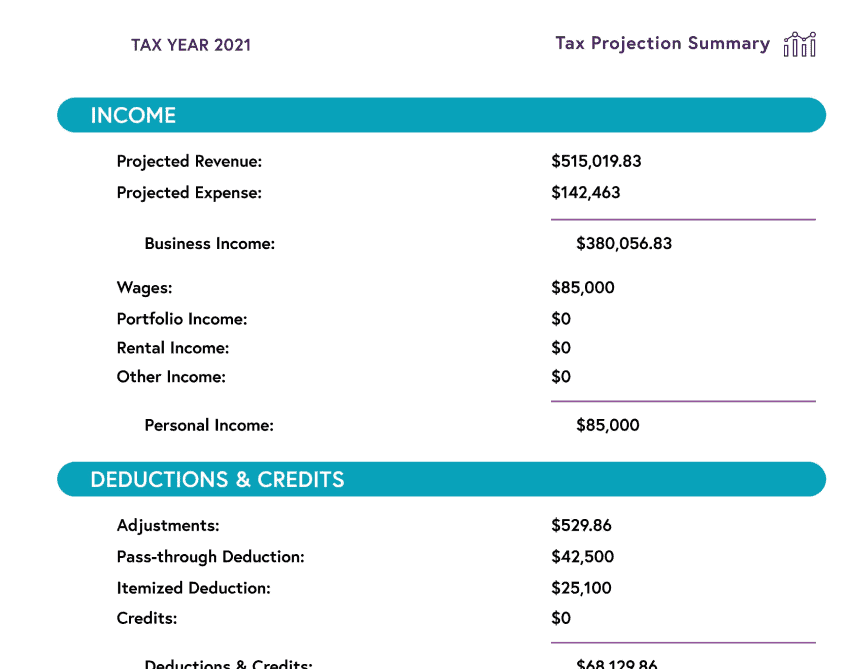

Tax Planning and Projections

Every quarter we give you a current year tax projection based on your current income and suggest ways to invest your money to minimize, and even eliminate, your taxes.

Our business tax solutions give you peace of mind

Try a tax season without the stress and the headaches. Sign up and meet with your E.A tomorrow. Let us show you what a difference MassTax can make in your tax life. We have solutions for all businesses, big and small.

Tax Planning Services

With our business tax & bookkeeping service you will receive a tax strategy report at the end of every tax year which outlines areas in which you could have invested to save on your taxes.

We also provide quarterly tax projections based on your current business income and deductions, empowering you to make savvy investments decisions to help ease your year-end tax burden.

Quarterly Tax Projection

We give you an updated quarterly tax projection based on your current business income and deductions. This gives you the opportunity to adjust spending habits to minimize taxes.

Annual Strategy Report

Our report gives you unique insight in to comprehensive strategies you can implement to help save on taxes in the future.

IRA Planning

Our IRA planning helps to make sound retirement decisions that maximize tax savings and help you build wealth for the future.

Tax planning included with business bookkeeping and tax preparation package

Our tax planning services come standard with our most comprehensive bookkeeping and tax plans at no extra cost. Save thousands in taxes, and thousands in tax planning, by signing up for our complete package.

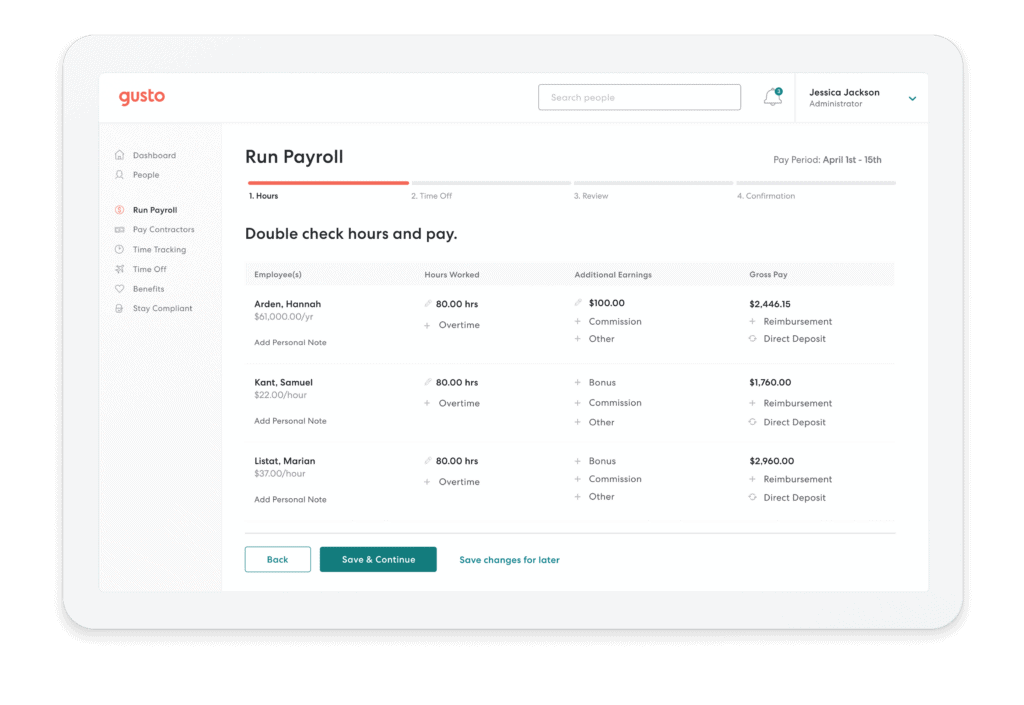

Payroll Services

We partner with Gusto to provide the best payroll experience possible. Gusto are the leading payroll and benefits provider for small businesses and offer a seamless and efficient payroll experience. Gusto’s platform allows us to easily process payroll, manage your employee benefits, and ensure compliance with labor laws. Your employees will have access to Gusto’s self-service portal, where they can view their pay stubs, request time off, and update their personal information.

Already using a different payroll service and want to make the switch? We can help!

Quarterly Taxes

Our payroll services include your quarterly tax reports as standard with your payroll package at no extra cost. We charge a small fee per W2 at the end of the year to keep things simple.

Tax Payments

We’ll handle your tax payments according to your federal and state payroll tax schedules so you have peace of mind knowing it’s done right.

Direct Deposit

No more writing checks! We can set your employees up for direct deposit so they always receive their checks on time and you don’t have to worry about writing and mailing checks.

Simplified Payroll. Simplified Life.

Our payroll services help take the stress of payday off your shoulders. We provide you with all the paperwork you need to collect, and can even direct deposit paychecks – one less thing for you to worry about.

Affordable plans for any size business

Starter Plan

-

For businesses with gross revenue up to $100k per year

Standard Plan

-

For businesses with gross revenue from $100k-$300k per year

Extended Plan

-

For businesses with gross revenue from $300k-$500k per year

Max Plan

-

For businesses with gross revenue from $500k-$1M per year

All tax preparation & bookkeeping plans come with:

- Dedicated Accountant

- Monthly Bank Reconciliations

- Monthly Financial Statements

- Monthly Sales Tax Reports

- 24/7 Access to Portal and Documents

- Premium Support

- Tax Return for One Business (Sole Prop, 1065 or 1120S)

- One Individual Tax Return (1040)

- Quarterly Tax Projections

- Annual Tax Planning Report

Starter Plan

-

For businesses with gross revenue up to $100k per year

Standard Plan

-

For businesses with gross revenue from $100k-$300k per year

Extended Plan

-

For businesses with gross revenue from $300k-$500k per year

Max Plan

-

For businesses with gross revenue from $500k-$1M per year

All bookkeeping plans come with:

- Dedicated Accountant

- Monthly Bank Reconciliations

- Monthly Financial Statements

- Monthly Sales Tax Reports

- 24/7 Access to Portal and Documents

- Premium Support

You aren’t just a client, you’re a friend!

We treat all our clients like we’d treat our friends — with the utmost respect and care. We go out of our way to find deductions, and ensure we deliver the best service possible.