Corporate Tax Return Filing

Will I have the same experts working on my engagement each month?

With our bookkeeping services, you’ll consistently work with the same bookkeeper and supervisor. You’ll have their direct contact information and can communicate with them through our practice management software.

Similarly, for tax services, you’ll have a consistent IRS Enrolled Agent year after year. You can directly contact them via email, online meetings, phone, or any method you prefer.

How long is the engagement period?

You can cancel anytime, however, for those business owners who are subscribed to our tax preparation and bookkeeping services packages, you must have paid for your subscription through the end of your fiscal period.

For example, if your fiscal year is January – December, you must have paid for your services through the end of December.

If I need a prior year return prepared, what is the pricing for that?

For new clients that are subscribed to our tax preparation and bookkeeping services, prior year returns are charged at the rates listed above or via our personal tax services table. We can prepare as many years as you need and each year is the same price as a current year tax return as shown in the pricing options above.

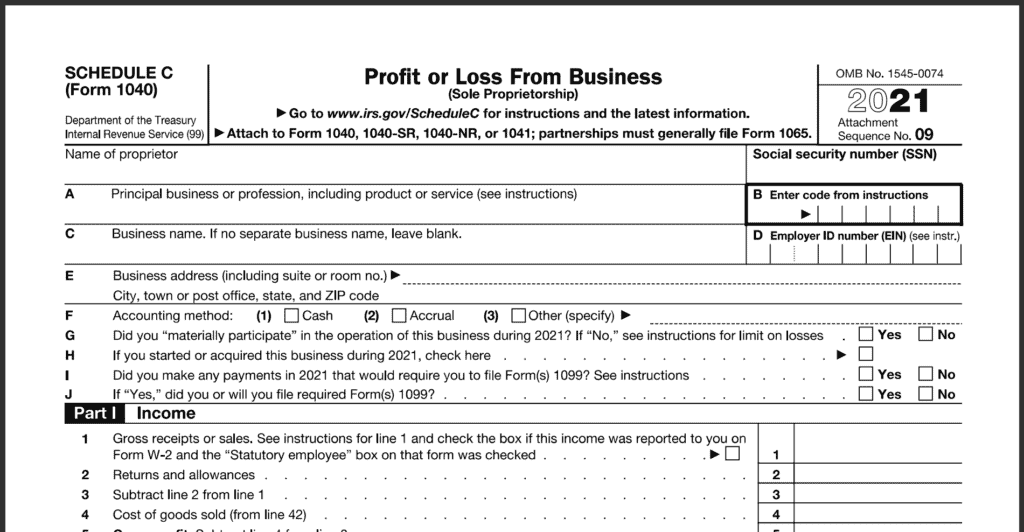

Do I need to file a corporate tax return as a single-member LLC or sole proprietorship?

If you are a single-member LLC, for tax purposes, you are typically taxed a sole proprietor. Therefore, you would not fall under the corporate tax return pricing. Full Service Business Tax is for incorporated business owners who file their business taxes as a partnership, Multi-Member LLC, S-Corp, or C-Corp. If you need to file as a sole proprietor, see our personal taxes pricing page.

What do I need to do to prepare for filing?

Have your bookkeeping clean and up to date. Make sure they’re tax-ready so your expert can get to work: transactions categorized, accounts reconciled, and balance sheets balanced. Also, have your tax documents handy, and ready to send to us easily and securely. This includes all relevant forms: and a copy of your prior year forms 1065 if you file as a partnership or forms 1120, or 1120S if you file as a C-Corp or S-Corp, respectively. Schedule K-1, profit & loss statements, balance sheets, and end-of-year bank statements. If you would like us to handle your bookkeeping, see our tax add-ons below.

What if I need to file an extension?

You may file form 7004 to file an extension for your Partnerships, C-Corp or S-Corp. This will give you a 6-month extension to file your tax return.

Important: even if you obtain an extension of time to file, you must still pay your tax due in full by the original tax deadline. Otherwise, interest and penalties will be assessed on the amount owed. The tax return will be due on September 15 if you file form 7004. If you need our help to file form 7004, please see our tax addons below.

Are there any additional charges or costs than what I see here?

See the add-ons below if you want modifications or additional services, but we don’t have any other fees you will pay other than what you see on this page.

Tax Package Add-ons

Extensions — $125 each

Catch up bookkeeping – starting at $125/mo (see bookkeeping price table)

Payroll Setup – $249 – We will setup your payroll in Gusto and show you how to run and pay employees via direct deposit or check. (does not include the Gusto monthly fee or our fee to run payroll for you)