Full-Service Tax Prep you can count on

Tax laws and regulations can be complex and are constantly changing

A tax professional has the knowledge and expertise to navigate the tax code and ensure that you are taking advantage of all applicable deductions and credits. Additionally, a tax professional can help you to avoid common mistakes that could lead to an audit or penalties. Furthermore, a tax professional can save you time and effort by handling the tedious tasks involved in tax preparation, allowing you to focus on your business or personal life. Overall, hiring a tax professional can provide peace of mind and help to ensure that your taxes are accurately and efficiently prepared.

You aren’t just a client, you’re a friend!

We treat all our clients like we’d treat our friends — with the utmost respect and care. We go out of our way to find deductions, and ensure we deliver the best service possible.

Have confidence in your taxes

Expertise: We have the knowledge and experience to accurately prepare and file your taxes, ensuring that you are in compliance with tax laws and maximizing your tax benefits.

Time-saving: We save you time by handling the tax preparation process for you, allowing you to focus on other important tasks.

Stress-reducing: Tax preparation can be stressful and time-consuming. We help reduce this stress by taking care of the process for you.

Avoiding mistakes: Mistakes on your tax return can lead to penalties and interest. We help you avoid mistakes and ensure that your tax return is accurate and complete.

Maximizing deductions: We help you identify deductions and credits that you may be eligible for, which can save you money on your tax bill.

Professional representation: If you are audited by the IRS or need to deal with any other tax-related issues, we can provide you with professional representation and guidance. *(we recommend purchasing audit defense at the time you purchase your service to minimize out-of-pocket representation costs in the event of an audit)

Tax Credits

We make sure you receive the maximum tax credits you’re entitled to. Earned Income Tax Credit, Child Tax Credit, American Opportunity Tax Credit? No problem.

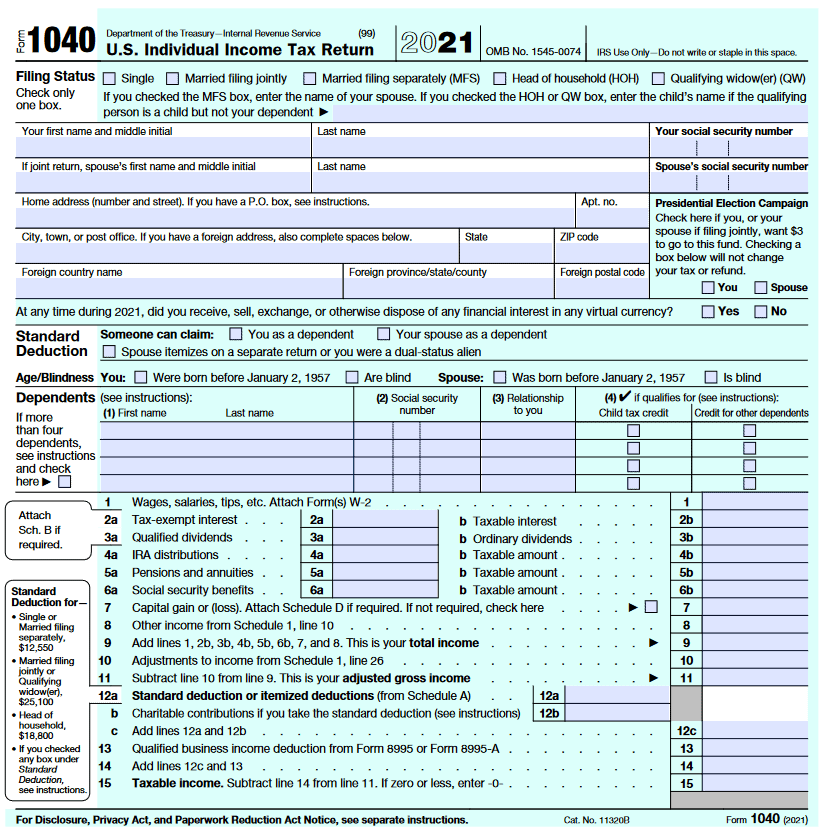

All Schedules

Whether you have rental properties, investment income, or business income on a Schedule C, we take care of it all giving you peace of mind.

Direct Deposit

If you are due a tax refund, we will instruct the IRS to direct deposit it in to your account so you receive your refund timely.

Pick the plan the fits your situation

Deluxe

-

Save $20 over TurboTax

-

Maximize deductions & credits

-

State return + $49

Premier

-

Save $30 over TurboTax

-

Investments & Rental Property

-

State return + $49

Self-Employed

-

Save $10 over TurboTax

-

Personal & business income / expenses

-

State return + $49

Basic

Simple tax returns onlyWhat qualifies?

-

Save $20 over TurboTax

-

State return included

-

A tax expert can prep, sign and file your taxes for you

-

One-on-one guidance and year-round tax advice

-

Your taxes done right, guaranteed

-

Covers W-2

-

Earned Income Tax Credit (EIC) and child tax credits

-

Student loan interest

Deluxe

Maximize deductions & credits-

Save $20 over TurboTax

-

State return + $49

-

A tax expert can prep, sign and file your taxes for you

-

One-on-one guidance and year-round tax advice

-

Your taxes done right, guaranteed

-

Covers W-2

-

Earned Income Tax Credit (EIC) and child tax credits

-

Student loan interest

-

Mortgage and property tax deductions

-

Charitable donations over $300

-

Unemployment income

-

Education expenses

Premier

Investments & Rental Property-

Save $30 over TurboTax

-

State return + $49

-

A tax expert can prep, sign and file your taxes for you

-

One-on-one guidance and year-round tax advice

-

Your taxes done right, guaranteed

-

Covers W-2

-

Earned Income Tax Credit (EIC) and child tax credits

-

Student loan interest

-

Mortgage and property tax deductions

-

Charitable donations over $300

-

Unemployment income

-

Education expenses

-

Covers stocks, bonds, and ESPPs

-

Rental property income and refinaricing deductions

-

Gains and losses from cryptocurrency transactions

Self-Employed

Personal & business income / expenses-

Save $10 over TurboTax

-

State return + $49

-

A tax expert can prep, sign and file your taxes for you

-

One-on-one guidance and year-round tax advice

-

Your taxes done right, guaranteed

-

Covers W-2

-

Earned Income Tax Credit (EIC) and child tax credits

-

Student loan interest

-

Mortgage and property tax deductions

-

Charitable donations over $300

-

Unemployment income

-

Education expenses

-

Covers stocks, bonds, and ESPPs

-

Rental property income and refinaricing deductions

-

Gains and losses from cryptocurrency transactions

-

Ideal for self-employed (1099-NEC) income

-

Finds deductions specific to your line of work

-

Guidance for freelancers and small business owners

-

Maximize deductions for work expenses (Schedule C)

-

Easily import your 1099-NEC with just a snap